If you have money, then you are looking for an opportunity to invest it as profitable as possible. Or vice versa, as reliable as possible. It would seem that IPO is an opportunity that is just about that. Generally speaking, IPO is not for investors. Here’s why.

An initial public offering is one of the options for businessmen to profitably raise money for the development of their business. This is a mechanism used by companies to issue their own shares and offer them to market participants.

How to borrow money

Suppose a certain company needs to raise capital to develop its own business. Then it has several ways. If any bank allows, the firm can borrow from the bank and repay it over a subsequent period of time with bank interest. A firm can issue bonds to the market and choose the coupon amount to pay out to investors who buy those bonds. Again, the funds will have to be returned with interest. Not to the bank, but to investors.

There is a third option as well. It is to issue and sell its own shares on the market, exchanging them for a part of the company itself. That is, the company has to share with the investor a part of the possible profit through the payment of dividends. But the company does not need to return the money, it can use it to expand its business.

Who takes all the risks

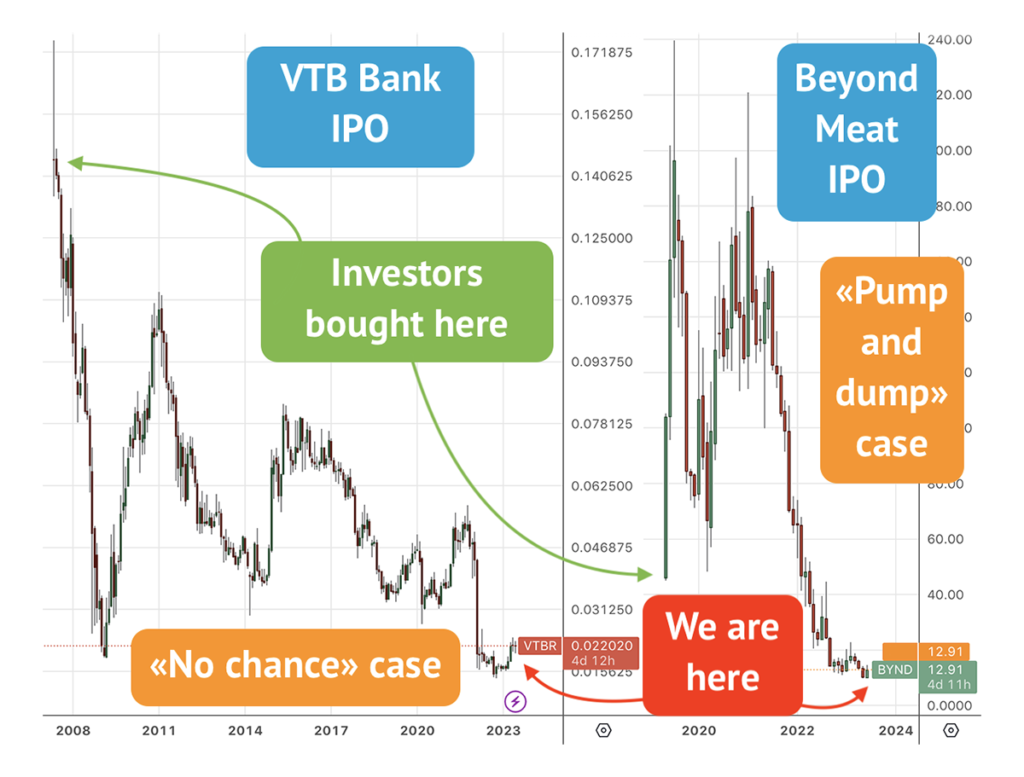

Thus, the investor assumes all risks when buying shares. And the company issuing shares is almost risk free. It goes without saying that in exchange for risk, the investor expects to receive dividends. In addition, he hopes his shares will rise in price. But here we have nuances. The most important thing is at what price you buy these shares. The fact is that companies choose to conduct an IPO during the growth of markets. This is done in order to sell at a higher price.

However, the investor has other options in that period. For example, there are many growing well-known and reliable stocks in the secondary market. Such stocks have history of quotes, and you can rely on it when making decisions. It is possible to invest there with a certain degree of risk. Given that IPO is practically a lottery.

Double risk lottery

Moreover, you risk twice by participating in the IPO. First, the price must go up immediately. It doesn’t always happen that way. Secondly, even if you are lucky, you need to get out in time to avoid getting pumped and dumped.

Thus, IPO is a necessary and very good mechanism. But this is more for firms, not for investors. IPO is just one of the options to make money on the market. And this option is far from the most reliable. Take care of your money! Take smart risks.