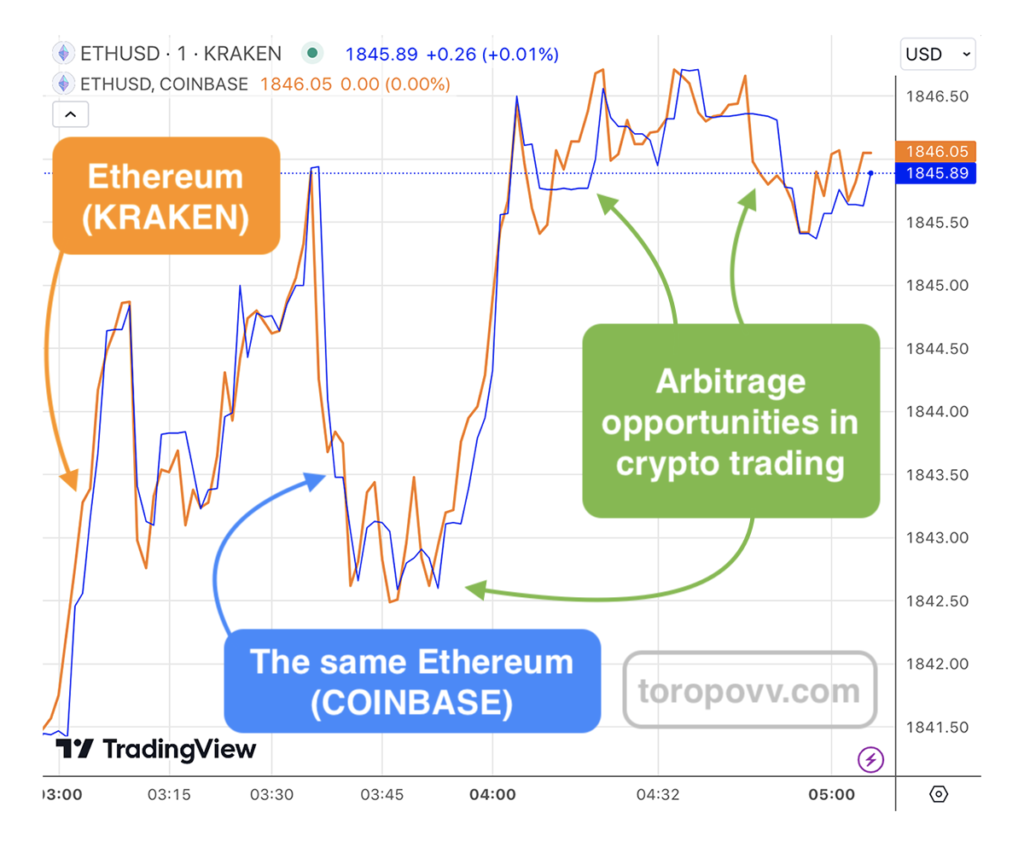

Arbitrage traders are individuals or entities that engage in a trading strategy known as arbitrage. Arbitrage is the practice of taking advantage of price discrepancies for the same asset or security across different markets or trading platforms.

By exploiting these price differences, arbitrage traders aim to make risk-free profits.

Arbitrage traders exploit market imbalances

Arbitrage opportunities arise due to inefficiencies or delays in the way information is disseminated and prices are adjusted in different markets. These inefficiencies can be caused by factors like market participants’ behavior, trading platforms’ processing times, or regional variations in supply and demand. Arbitrage traders seek to exploit these temporary imbalances before they are corrected.

Strategies for arbitrage traders

There are several types of arbitrage strategies:

Spatial Arbitrage

This involves taking advantage of price differences for the same asset in different geographic locations. For example, a commodity like gold might be priced slightly differently in two different countries due to factors like transportation costs or import/export regulations.

Temporal Arbitrage

In temporal arbitrage, traders exploit price differences that occur over time. For instance, the same stock might be trading at different prices in the after-hours market compared to the regular trading hours.

My solutions on MQL5 Market: Vladimir Toropov’s products for traders

Statistical Arbitrage

This strategy involves identifying and exploiting mispricings between related securities based on historical patterns or statistical relationships. It often involves trading pairs of related assets (like two stocks from the same industry) and profiting from deviations from their historical price ratios.

Risk Arbitrage

Also known as merger arbitrage, this strategy is used when companies are undergoing mergers or acquisitions. Traders buy shares of the target company at a lower price and sell them at a higher price once the merger is completed.

Convertible Arbitrage

This involves trading in convertible securities, such as convertible bonds or preferred stock, to take advantage of the price difference between the underlying security and its convertible derivative.

Arbitrage traders and trading features

It’s important to note that arbitrage opportunities are usually short-lived, as they tend to disappear as markets adjust to correct the price discrepancies. As a result, arbitrage trading requires sophisticated tools, fast execution, and advanced algorithms to identify and exploit these opportunities quickly.

Arbitrage trading is not without risks. Technology glitches, sudden market movements, and changes in market conditions can lead to losses. Additionally, as more participants engage in arbitrage, the opportunities become scarcer and harder to capitalize on. However, skilled arbitrage traders with access to advanced technology and market insights can still find profitable opportunities in various markets.