Smart investing is not just about picking stocks or trying to time the market; it involves understanding the fundamentals of different investment options, diversifying a portfolio, and maintaining discipline. You might be surprised, but there are some relatively simple methods to do this. Let’s get right to the point without getting distracted by the introduction.

Table of contents

Smart investing doesn’t require you to be smart

How to invest smartly

Continuously diversify your investments

Take a long-term approach with compound interest

Invest in technology

Smart investing in new technologies

Identify key emerging technologies

Choose your investment vehicle

Follow industry leaders and innovators

Stay updated with trends

Examples of smart investing

Xerography

Instant photography

Alternatives

My products in detail

Smart investing doesn’t require you to be smart

Smart investing involves a high probability of making a profit or a very high profit. That’s why it’s worth learning how to do it. The first good news is that it’s not difficult, and you can understand it. However, there is also bad news. It takes time to learn. So, I suggest you take advantage of my simple tips on what you need to do to successfully invest your money in the stock market.

But first, we need to understand how to invest wisely, and only then will we get acquainted with specific examples of where you can invest.

How to invest smartly

Continuously diversify your investments

Diversification is a cornerstone of smart investing. You can reduce risk by spreading investments across various asset classes — such as stocks, bonds, real estate, and commodities.

Image taken from: A Guide to Building a Diversified Portfolio

For instance, if the stock market experiences a downturn, a diversified portfolio may still benefit from other investments, like bonds, which often perform better during economic slowdowns. Never forget about this vital method!

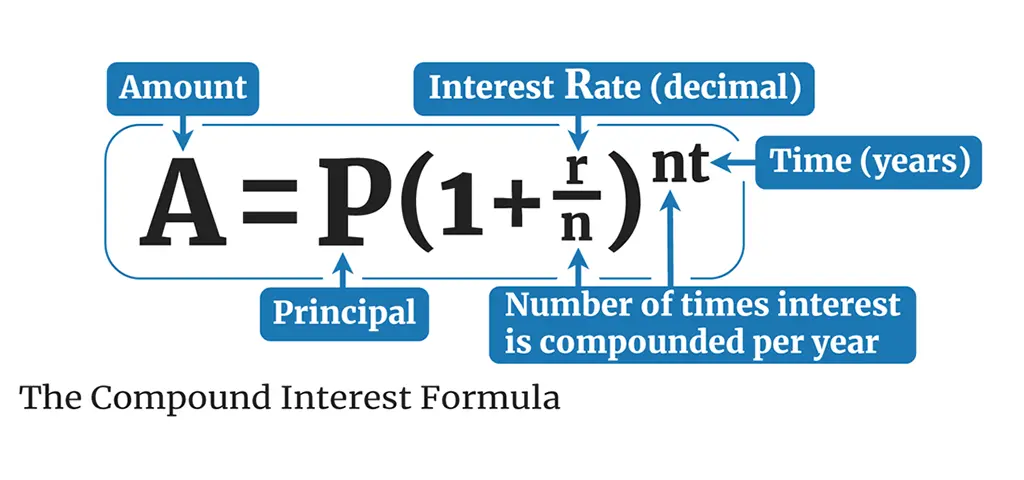

Take a long-term approach with compound interest

Smart investing often involves a long-term perspective, capitalizing on compound interest to grow wealth over time. For example, if an investor starts with $10,000 and contributes $200 monthly into a retirement account with an average annual return of 7%, they could potentially have around $500,000 in 30 years.

Image taken from: Compound Interest Calculator

Compound interest allows you to earn returns on both your initial investment and the accumulated gains, making it a powerful wealth-building tool.

Invest in technology

Investing in new technology can be highly promising due to several factors contributing to its potential for high returns and significant economic impact. New technologies often address unmet needs, create efficiencies, or enable new forms of productivity. Companies in these sectors can experience exponential revenue growth as technology grows and gains market share.

Smart investing in new technologies

In my blog, I describe new technologies and the opportunities they open up for investors. The matter is that investing in new technologies can be highly rewarding, although it carries specific risks. Here are simple tips on how to approach this type of investment:

Identify key emerging technologies

Start by researching major technology trends that promise to grow significantly in the future. Current areas with high growth potential include:

- Artificial Intelligence (AI) and Machine Learning

- Blockchain and Cryptocurrencies

- Renewable Energy (solar, wind, etc.)

- Electric Vehicles (EVs) and Battery Technology

- Biotechnology and Genomics

- Internet of Things (IoT)

- 5G and Next-Generation Connectivity

- Quantum Computing

Choose your investment vehicle

You see, there are different ways to invest money. That is, you can thoughtfully choose the method that suits you best because the financial industry has generated many exciting and convenient tools. So, what do we have here?

Smart investing in individual stocks

Investing in companies focusing on new technology (e.g., AI, EVs, renewable energy) allows you to benefit if they succeed directly. However, individual stocks can be volatile and require thorough research.

ETFs (Exchange-Traded Funds)

Technology-focused ETFs can provide exposure to various companies within a particular tech sector, reducing the risk associated with investing in individual stocks. Examples include:

- ARK Innovation ETF (ARKK) for disruptive tech

- Global X Robotics & Artificial Intelligence ETF (BOTZ)

- iShares Global Clean Energy ETF (ICLN) for renewables

Mutual funds

Some funds focus on growth and technology companies, offering a managed approach with some diversification. Please note that mutual funds have their features. You may not always be able to dispose of the securities of a particular fund freely. These organizations may impose various restrictions, which you should familiarize yourself with before buying a share. In general, the concept of mutual funds seems outdated these days.

Smart investing in startups

Investing in startups through crowdfunding platforms or as an accredited investor in a venture capital fund can provide exposure to early-stage tech companies with high growth potential. This approach is riskier and often illiquid, but returns can be substantial if the company succeeds.

Follow industry leaders for smart investing

Tech giants (like Google, Microsoft, Tesla, etc.) often invest heavily in R&D and acquire smaller companies to stay ahead. Investing in these giants can provide indirect exposure to new tech. You can also track top venture capital funds and innovation-focused ETFs, as their holdings can reveal high-potential startups and emerging tech trends.

Stay updated with trends

The tech landscape changes quickly. Stay updated with technology news and trends. Use various sources, but be sure to read my blog, where I share information about new technologies and reflect on modern trends for smart investing. Here are some examples of posts about cutting-edge technologies:

CAES technology

CAES technology is an integral part of the energy transition to renewable energy sources. Learn more…

DNA storage technology

DNA storage involves developing artificial molecules that can pack petabytes of data into one gram of substance. Learn more…

LIDAR. Laser-sensor technology

LIDAR is a remote sensing technology that uses laser light to measure distances and create detailed 3D maps. Learn more…

Before investing, conduct thorough research to understand whether a particular company has potential and can succeed. To do this, feel free to read my blog and subscribe to my social networks. I hope you find it fun and helpful.

Examples of smart investing

You probably expect examples from those on everyone’s lips, such as Apple, Tesla, and other successful modern companies. However, their stories are still ongoing. In addition, these companies have already shown significant growth. Therefore, you can hardly expect a fantastic hundreds of percent return from investing in them. Although, don’t exclude this option.

In any case, look for new opportunities, companies that have not yet become popular for some reason. Let’s see what an investor can get if he buys shares of a promising company in time. I give two eloquent examples of success stories connected with famous technology brands in the stock market and real life. Please pay attention to the fact that these stories always happen according to similar scenarios.

Smart investing in xerography

Investors who bought Haloid stocks at the right time, particularly in their early years when the company pioneered photocopy technology, earned substantial returns. The thing is, Haloid company is the original name of Xerox Corporation.

Xerox started as the Haloid Company, which primarily made photographic paper. In the late 1940s, Haloid began developing xerography, a revolutionary dry-copying process that became the foundation of Xerox’s technology.

In 1959, Haloid introduced the Xerox 914, the first successful automatic plain paper copier. This product was a massive success, leading Haloid to rebrand itself as Xerox Corporation in 1961. The company’s stock surged in value during the 1960s as the copier market expanded rapidly.

After the success of the Xerox 914, the company dominated the copier market and experienced explosive revenue growth. Xerox became a household name and, by the mid-1960s, was considered a blue-chip stock.

The value of Xerox shares soared, especially in the early and mid-1960s, as it established a near-monopoly in the copier industry. During this period, Xerox was among the “Nifty Fifty” stocks — a group of high-growth companies considered safe bets.

Investors who bought Xerox shares in the early 1960s and held them into the 1970s earned more than 10,000% returns, turning small investments into significant wealth.

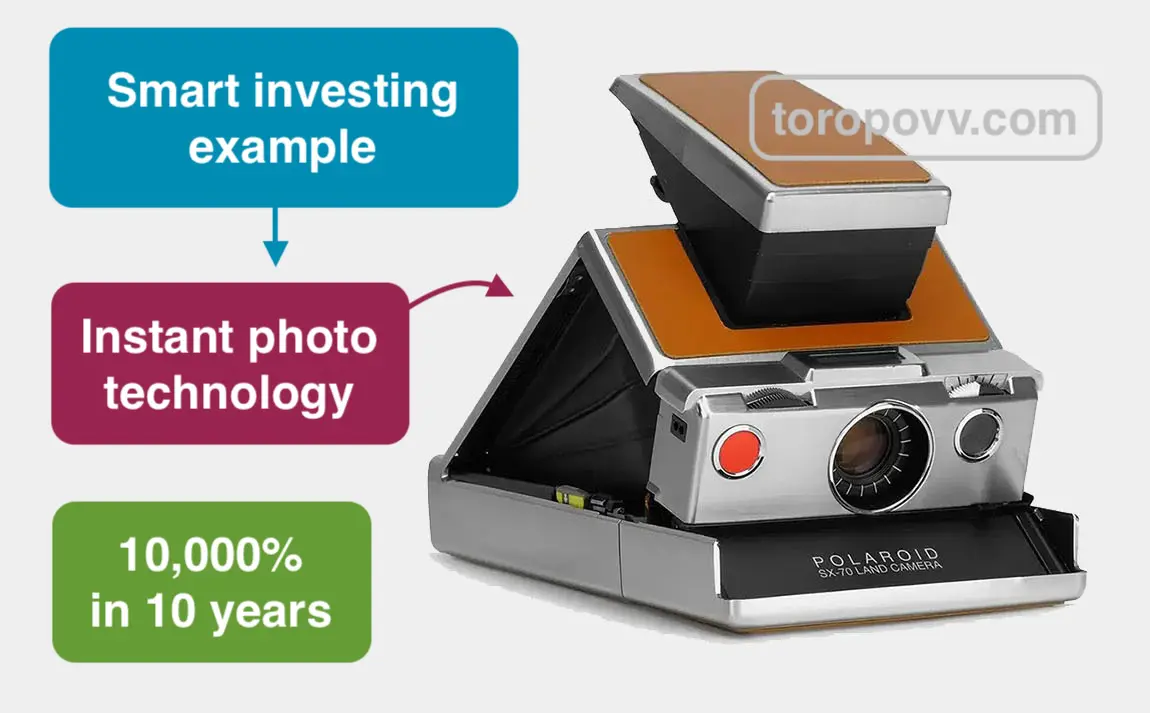

Smart investing in instant photography

Polaroid was founded in 1937 by Edwin Land and initially focused on polarized lenses. It later shifted to cameras, with Polaroid’s revolutionary instant photography technology patented in 1948. The Polaroid Model 95, the first instant camera, was a huge hit, and sales increased.

Polaroid went public in 1957, and as the popularity of instant photography surged, its stock skyrocketed. The stock price reportedly grew by over 10,000% during this time, as the company was also part of the “Nifty Fifty” stocks. This growth meant a relatively small investment in Polaroid in the early years could have become a sizable fortune.

Polaroid continued to innovate, introducing the SX-70 camera in 1972, which offered instant color photographs and became a significant success. The 1970s were the golden years for Polaroid, and the stock performed well because instant photography remained popular.

During this period, the stock price climbed substantially, rewarding long-term investors who had held shares since the early years. For example, an investment made in the 1960s could have appreciated hundreds of percent by the late 1970s or early 1980s.

Alternatives to smart investing

The development of new technologies is a powerful trend in itself. So be on trend! However, remember that technology can be unpredictable. Diversifying across tech sectors (e.g., AI, biotech, renewables) can help spread risk and improve your portfolio’s resilience. To reduce overall risk, consider balancing your technology investments with more stable assets (such as blue-chip stocks or bonds).

If you have a closer planning horizon than years and decades, look closer at short-term trading using trading robots. I am professionally engaged not only in investments but also in the implementation of various speculative strategies in my trading algorithms. Feel free to check out my products below.

My products in detail

Learn more about all my products for traders and unlock the potential of automated trading!