Counter-trend trading is a strategy where traders aim to profit by going against the prevailing market trend. While most traders prefer to “ride the wave” of momentum, counter-trend traders take the opposite approach, looking for opportunities where they believe a trend is about to reverse. In this article, we’ll explore the mechanics of this strategy and some key concepts to enhance your method.

Table of contents

What is counter-trend trading?

Advantages of counter-trend trading

High profit potential

Overbought / oversold markets

Shorter trade durations

Market inefficiency

Disadvantages of counter-trend trading

High risk

False reversals

Challenging timing

Psychological stress

Limited profit potential

Typical financial instruments for counter-trend trading

Forex (Currency pairs)

Commodities (Gold, oil, etc.)

Stocks (Equities)

Indices (S&P 500, Nasdaq, etc.)

Cryptocurrency

How to identify counter-trend opportunities

Overbought / oversold indicators

Divergence with momentum indicators

Candlestick patterns

Support and resistance levels

Fibonacci retracement levels

Risk management in counter-trend trading

Use tight stop losses

Trade small positions

Set realistic profit targets

Wait for confirmation

Conclusion

My products in detail

What is counter-trend trading?

Counter-trend trading focuses on identifying potential turning points where an existing trend is likely to lose strength and reverse. The idea is to take advantage of overextended market conditions, whether the market is overbought in an uptrend or oversold in a downtrend. These traders aim to capture the market’s natural pullbacks or reversals before the broader market catches on.

Instead of following the crowd, counter-trend traders look for signs that the current trend is weakening and that the price will move in the opposite direction, at least temporarily.

Advantages of counter-trend trading

High profit potential

Counter-trend trading can offer substantial profits if a trader correctly identifies a trend reversal. There are times when the trend reverses very frequently and more or less systematically.

By catching the market at its turning point, traders can capitalize on significant price swings that occur when trends shift direction.

Overbought / oversold markets

Counter-trend traders often target overbought or oversold markets. When a market is pushed to extremes, it is likely to correct, providing opportunities for traders to profit from a reversal.

Shorter trade durations in counter-trend trading

While trend traders may hold positions for extended periods, counter-trend traders typically benefit from shorter-term price corrections. This can lead to quicker trade outcomes and potentially more frequent trading opportunities.

Market inefficiency

Counter-trend traders exploit market inefficiencies caused by herd behavior. When the market is overly bullish or bearish, emotions can drive prices to unsustainable levels, and counter-trend traders capitalize on these psychological extremes.

However, be careful. It is extremely difficult to guess the price reversal point. In addition, strong trends suddenly appear and disappear in the market. Therefore, reversal strategies have another side.

Disadvantages of counter-trend trading

High risk

Counter-trend trading is inherently riskier than trend-following strategies because it goes against the prevailing market sentiment. If the trend continues longer than expected, traders can experience significant losses.

In addition to these general comments, there are also some specifics. They mainly concern the difficulties of determining price reversal points.

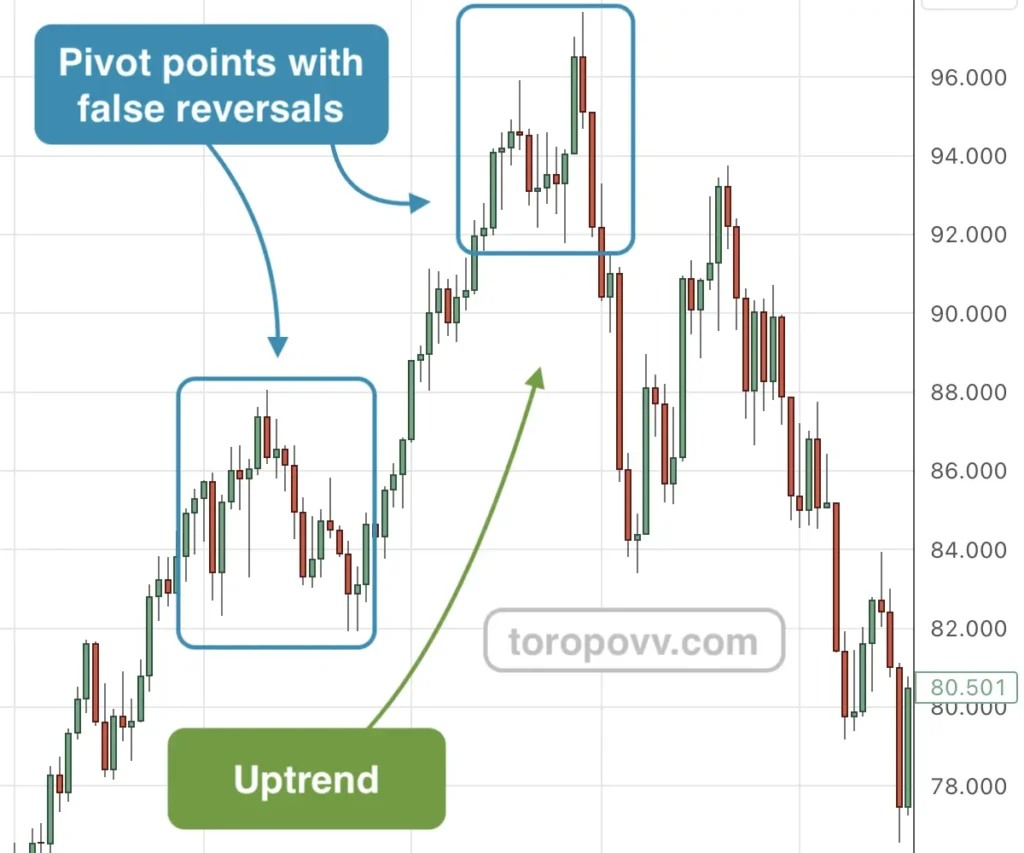

False reversals

A major challenge of counter-trend trading is distinguishing between genuine trend reversals and temporary pullbacks. It is not uncommon for traders to enter a trade too early, mistaking a minor retracement for a full reversal.

In the picture above, the price reversed only after false breakouts. This situation happens very often in the market.

Challenging timing in counter-trend trading

Precise timing is critical in this trading strategy. Entering too early can result in large losses if the trend continues, while entering too late may reduce the profit potential of the reversal.

Psychological stress

Trading against the trend can be psychologically demanding, as it often feels uncomfortable to take a position that opposes the majority of market participants. This can lead to second-guessing and emotional trading mistakes.

Limited profit potential

Unlike trend-following strategies that aim to ride long-term trends, counter-trend trades are typically shorter in duration. As a result, the profit potential may be smaller if the market only experiences a minor correction.

Typical financial instruments for counter-trend trading

Counter-trend trading can be applied across a range of financial instruments, particularly those prone to sharp reversals due to overbought or oversold conditions. Below are the most common markets where counter-trend strategies are effective:

Counter-trend trading in Forex (Currency pairs)

The forex market often exhibits strong trends that can become overextended. Counter-trend traders in the forex market target currency pairs that have moved too far in one direction, using technical indicators like the Relative Strength Index (RSI) to identify when a reversal is likely.

Commodities (Gold, oil, etc.)

Commodities such as oil and gold can experience rapid price movements due to external factors like geopolitical events or supply-demand imbalances. These markets often see exaggerated price moves, making them ideal for counter-trend strategies when they reach extreme levels.

Stocks (Equities)

Individual stocks, especially those in volatile sectors like technology or biotech, can experience sharp moves driven by earnings reports or market sentiment. Counter-trend traders look to capitalize on corrections after large price swings in these stocks.

Indices (S&P 500, Nasdaq, etc.)

Stock market indices are popular for counter-trend trading, especially during periods of high volatility or economic uncertainty. Indices can become overbought during strong bull runs or oversold during market panics, providing opportunities for reversals.

Counter-trend trading in cryptocurrencies

Cryptocurrencies like Bitcoin and Ethereum are known for their extreme volatility. After strong trends, these markets often experience sharp reversals, which present excellent opportunities for counter-trend traders.

How to identify counter-trend opportunities

Successful counter-trend trading relies on accurately identifying when a market is likely to reverse. Below are some common methods for spotting counter-trend opportunities:

Overbought / oversold indicators

One of the most reliable tools for counter-trend trading is the use of overbought and oversold indicators.

The Relative Strength Index (RSI) and Stochastic Oscillator are popular indicators that measure whether a market is overbought (above 70) or oversold (below 30). When these indicators signal extreme conditions, a reversal may be imminent.

Divergence with momentum indicators

Divergence occurs when the price makes higher highs or lower lows, but momentum indicators like the MACD or RSI show the opposite (lower highs or higher lows). This often signals that the trend is weakening, and a reversal is likely.

Candlestick patterns

Certain candlestick formations, such as “Doji,” “Hammer,” or “Shooting Star,” often indicate market indecision and can signal potential reversals.

These patterns are more effective when they occur near key support or resistance levels.

Support and resistance levels

Counter-trend traders often look for price levels where the market has previously reversed, known as support and resistance levels.

If the price approaches one of these levels and shows signs of weakening momentum, a reversal may be on the horizon.

Fibonacci retracement levels

The Fibonacci retracement tool can help counter-trend traders identify potential reversal points based on historical price movements. A common approach is to look for reversals near the 61.8% or 38.2% Fibonacci retracement levels.

Risk management in counter-trend trading

Since counter-trend trading carries a higher level of risk, effective risk management is essential for success. Here are some risk management strategies for counter-trend traders and trading robots:

Use tight stop losses

Given the risk of trading against the trend, it’s crucial to use tight stop losses to limit potential losses. Place your stop just beyond a key level, such as a recent high or low, to ensure you exit the trade if the trend continues.

Trade small positions

Counter-trend trades are inherently riskier, so it’s wise to reduce your position size compared to trend-following trades. Smaller positions help minimize the damage in case the trade goes against you.

Set realistic profit targets in counter-trend trading

Counter-trend trades tend to have shorter durations and smaller profit targets than trend-following trades.

Use a reasonable risk-to-reward ratio and avoid holding trades for too long in anticipation of a larger reversal.

Wait for confirmation

Rather than jumping into a counter-trend trade at the first sign of a potential reversal, wait for confirmation from multiple indicators, such as a clear candlestick pattern combined with overbought/oversold conditions.

Conclusion

Counter-trend trading is a sophisticated strategy that requires a deep understanding of market behavior, technical analysis, and risk management. While it can offer substantial rewards when executed correctly, it also comes with higher risks due to the nature of trading against the prevailing trend.

By focusing on overbought or oversold markets, using reliable technical indicators, and employing strict risk management, traders can capitalize on the market’s natural tendency to correct itself after extended moves. Counter-trend trading remains a valuable strategy for those willing to take on the challenges of going against the crowd, whether in forex, commodities, stocks, or cryptocurrencies.

Luckily, my products already do all this automatically. These are reliable trading algorithms that do not get tired and do not make mistakes in their calculations. Try them for free. Happy trading!

My products in detail

Learn more about all my products for traders and unlock the potential of automated trading!