Gas hubs are central points in a natural gas market where multiple gas suppliers and buyers come together to trade and exchange natural gas. They are interesting because they serve as a physical and financial marketplace for buying and selling natural gas.

Gas hubs’ mission

Gas hubs play a crucial role in Liquefied natural gas (LNG) trading by facilitating the supply and demand balance, price discovery, and market liquidity. Liquefied natural gas (LNG) is a form of natural gas that has been converted into a liquid state for easier storage and transportation.

The liquefaction process involves cooling natural gas to approximately -162 degrees Celsius (-260 degrees Fahrenheit), at which point it condenses into a liquid state. This extreme cooling is necessary to reduce the volume of the gas by about 600 times, making it more practical for storage and transportation.

The liquefaction process typically takes place at a specialized facility known as an LNG plant. The plant consists of several stages, including the removal of impurities such as water, carbon dioxide, and sulfur compounds. Once purified, the gas is cooled using a cryogenic process, often involving the use of refrigerants or cryogenic fluids, until it reaches its liquefaction point.

LNG storage and transporting

LNG is typically stored in large insulated tanks or containers specifically designed to maintain the low temperatures required to keep the gas in its liquid state. These tanks are often constructed with materials such as stainless steel or specially designed alloys that can withstand the extreme cold temperatures.

Transporting LNG involves loading the liquefied gas onto specialized cryogenic tankers. These tankers are typically double-hulled vessels with advanced insulation to prevent heat transfer and maintain the low temperature of the LNG. The LNG is transported in a liquid state to its destination, where it can be regasified and used as a source of energy.

At the receiving terminal, LNG is regasified using various processes, such as heat exchangers or recondensers, to raise its temperature back to its gaseous state. Once regasified, natural gas can be distributed through pipelines for various uses, including power generation, residential and commercial heating, industrial processes, and transportation.

LNG importance

Liquefied natural gas has become increasingly important in the global energy market due to its abundance, cleanliness compared to other fossil fuels, and its potential as a lower-carbon alternative for energy consumption. It enables the transportation of natural gas over long distances, connecting energy-producing regions with energy-consuming regions and facilitating international trade in natural gas.

Gas hubs serve as a link between the gas market and the LNG market, providing the necessary infrastructure, pricing mechanisms, and liquidity for efficient LNG trading.

My solutions on MQL5 Market: Vladimir Toropov’s products for traders

Gas hubs’ contribution to LNG trading

Here’s how gas hubs contribute to LNG trading:

Price Discovery

Gas hubs establish transparent and market-driven prices for natural gas, including LNG. As LNG is often priced based on the underlying gas prices at a specific hub, the gas hub’s price signals become a reference point for pricing LNG contracts. The interactions between buyers and sellers at the hub help determine the fair value of LNG, facilitating price discovery for LNG trades.

Gas hubs and Market Liquidity

Gas hubs enhance liquidity in LNG trading by attracting a broad range of market participants, including LNG suppliers, buyers, traders, and portfolio managers. The presence of multiple participants facilitates the matching of supply and demand, allowing for efficient and frequent transactions. This liquidity is crucial for the functioning of the LNG market, enabling market participants to access diverse sources of supply and providing flexibility in LNG portfolio management.

Contract Flexibility

Gas hubs offer standardized trading rules and contracts, which can be leveraged for LNG trading. For example, participants can use financial instruments linked to gas hub prices, such as futures contracts or gas-indexed swaps, to manage price risks associated with LNG. These derivative contracts allow for more flexibility in hedging and trading LNG volumes, contributing to the overall efficiency and stability of the LNG market.

Market Integration

Gas hubs facilitate the integration of LNG markets with regional or international gas markets. By connecting different gas markets, hubs enable the convergence of prices and the flow of gas, including LNG, between regions. This integration fosters competition, optimizes the utilization of LNG infrastructure, and enhances market efficiency.

Balancing and Flexibility

Gas hubs provide mechanisms for balancing gas portfolios, which is particularly relevant for LNG trading. LNG buyers or sellers can use the hub to offset imbalances between contracted LNG volumes and actual consumption. For example, if a buyer needs additional LNG volumes beyond their long-term contracts, they can source additional supplies from the spot market at the gas hub. This balancing and flexibility ensure a reliable and stable LNG supply.

Market Transparency

Gas hubs promote transparency by disseminating timely and accurate information on gas prices, market fundamentals, and supply availability. This transparency is valuable for LNG traders as it helps them make informed decisions about LNG purchases or sales. Market participants can access data on gas hub prices, supply-demand dynamics, and infrastructure capacity, which aids in assessing market conditions and optimizing LNG trading strategies.

Gas hubs and pricing

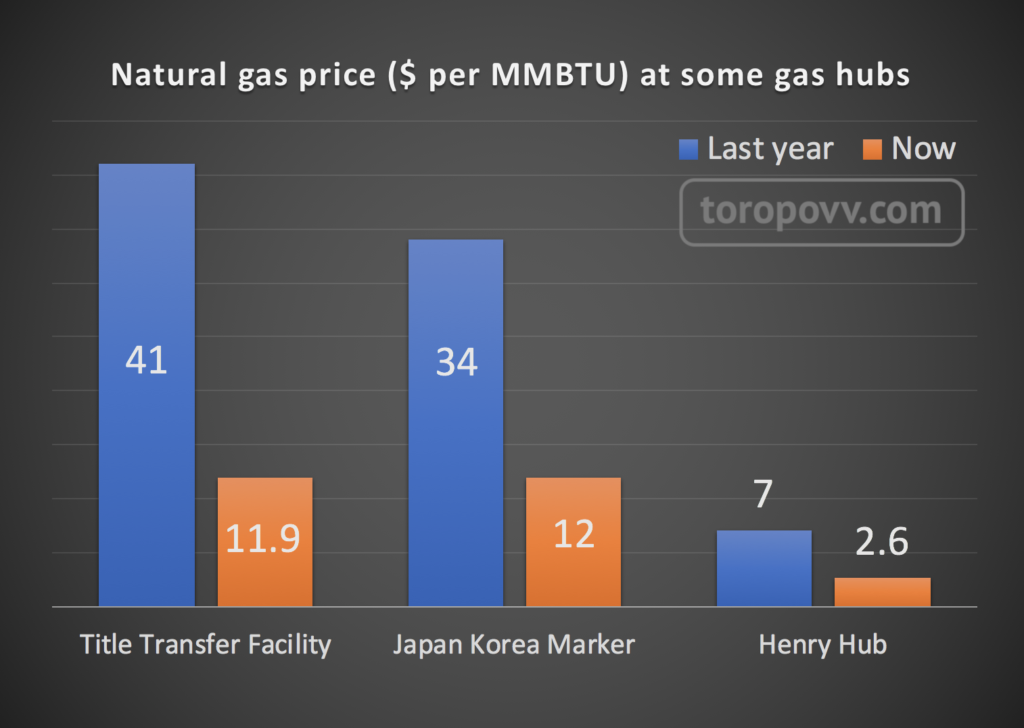

Some well-known gas hubs include the Title Transfer Facility (TTF) in the Netherlands, the National Balancing Point (NBP) in the United Kingdom, the Henry Hub in the United States, and Japan Korea Marker (JKM) in Northeast Asia.

Last year gas prices averaged $41/MMBTU on TTF, $34 on JKM, and $7 on Henry Hub. Now the cost of raw materials has fallen triple: gas is traded on TTF at $11.9, JKM at $12, and Henry Hub at $2.6.

MMBTU is a thermal unit of measurement for Natural Gas. It often measures LNG. You need to multiply the value in MMBTU by 35.8 to convert MMBTU into dollars per thousand cubic meters.