Suppose you have opened a trading account with $100,000. You made a deal and earned 1 thousand. That is, your profit on this trade is 1 percent of your capital. Fine. Now, let’s say you lose the same $1,000 on your next trade. How much did you lose as a percentage? One?

Incorrect answer. You lost 0.99 percent on this trade. Because 1,000 out of 100,000 is 1 percent, while 1,000 out of 101,000 is only 0.99 percent.

Percentage Increase: Compound interest

This seemingly small difference leads to big effects if we deviate further from the initial hundred percent. On the one hand, this is great. If the deposit grows, then each new profit becomes more and more in absolute terms, even if it is 1 percent of your trading account. This is called compound interest. We observe a similar effect when the share price rises. The higher the price, the more dollars that make up 1 percent of its value.

Percentage Decrease: Drawdowns

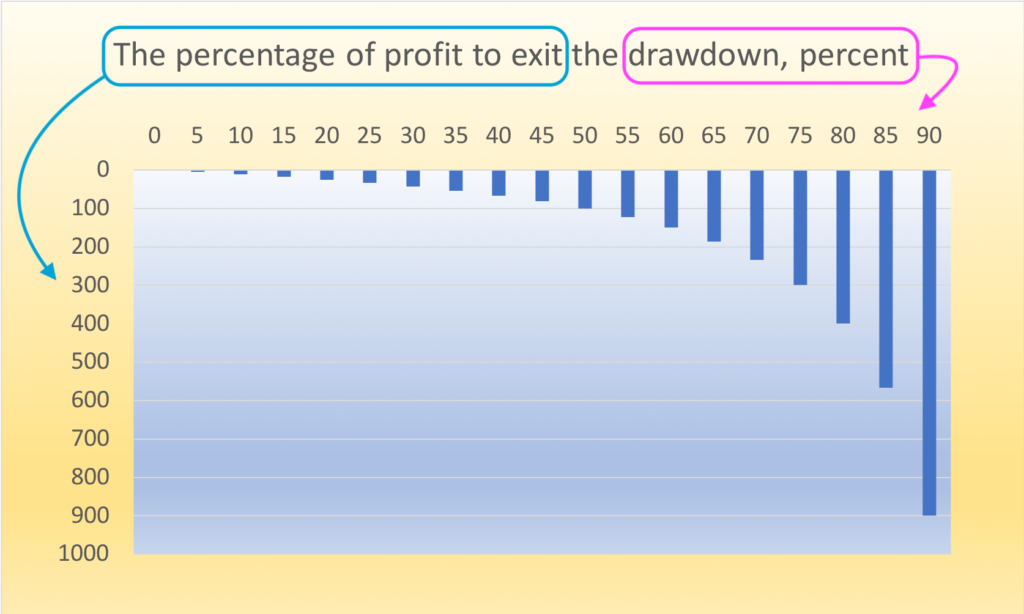

On the other hand, it’s not so good anymore. Trading is not only about profits, there are also drawdowns. A drawdown occurs from a series of losing trades. So the problem is that the deeper the drawdown, the harder it is to get out of it. This is purely mathematical.

What is a drawdown

In trading, drawdown represents the largest percentage decline from a previous high point to a subsequent low point. Drawdown is a measure used to assess the risk and volatility of an investment strategy.

To understand drawdown, let’s consider an example. Suppose you start with a trading account balance of $100,000. Over time, your account balance fluctuates due to your trading activities. At one point, your account reaches a high balance of $120,000. However, due to market fluctuations or trading losses, the value of your account starts declining and eventually hits a low point of $80,000 before recovering. In this case, the drawdown would be calculated as the percentage decline from the peak ($120,000) to the trough ($80,000), which is $40,000 or 33.33% of the peak value.

How percentage affects drawdown

Let’s see what’s going on. If everything is clear with small deviations from one hundred percent, plus or minus a little, then with large ones everything is more interesting. Let’s take a big value. 30 percent. If you get into such a drawdown, then to get out you need to make profits of almost 43 percent. It is very serious. And if the drawdown has reached a value of 50 percent, then you need 100 percent profit to break even.

Think about it. You have to double up your deposit to win back a 50% loss. Actually, this is what drawdowns in trading are dangerous for. Therefore, it is reasonable to closely monitor the drawdown and take the necessary measures to cope with it in time.

Pay attention to drawdowns in your strategy

Drawdowns are essential to consider because they provide insights into the potential risk and loss associated with a trading strategy. A larger drawdown indicates higher volatility and risk, while a smaller drawdown suggests more stable performance. Traders often monitor drawdowns to assess the effectiveness of their strategies, manage risk, and set appropriate stop-loss levels to protect their capital.

It’s important to note that drawdown is a measure of past performance and does not guarantee future results. Traders should consider other risk management tools and strategies in conjunction with drawdown analysis to make informed trading decisions.