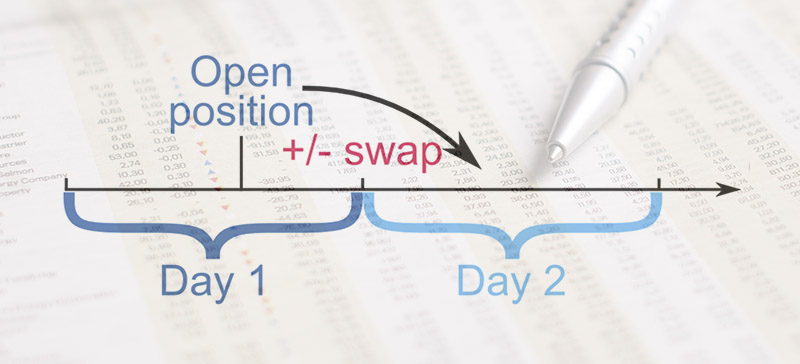

Swap charging, also known as rollover, is a mechanism used in the foreign exchange (FOREX) market to account for the interest rate differential between two currencies in a currency pair. When you engage in a trade, you are borrowing one currency to buy another.

Since currencies are issued by central banks and carry different interest rates, the interest rate differential can result in swap charges or credits.

How does swap charging work?

In forex trading, trades that are held open overnight incur swap charges or credits, depending on the interest rate differential between the currencies involved. If you are holding a currency pair where the base currency (the currency on the left side of the pair) has a higher interest rate than the quote currency (the currency on the right side of the pair), you will receive a swap credit. Conversely, if the base currency has a lower interest rate than the quote currency, you will be charged a swap fee.

Swap charges or credits are calculated based on the notional value of the position, the interest rate differential, and the number of days the position is held open. Typically, swap charges are calculated on a daily basis and automatically added or subtracted from your trading account at the end of each trading day.

How can swap charging affect trading results?

It’s important to note that swap charges or credits can significantly impact the profitability of longer-term trades, especially when trading currency pairs with large interest rate differentials. Traders who engage in carry trading strategies, where they aim to profit from interest rate differentials, pay close attention to swap rates.

Swap charging is primarily influenced by central bank interest rates, market expectations of future interest rate changes, and any adjustments made by the forex broker to reflect their own funding costs. It’s important to consult your forex broker or trading platform for specific swap rates as they can vary across brokers and currency pairs.

Additionally, some forex brokers offer Islamic or swap-free accounts that cater to traders who adhere to Islamic principles, which prohibit earning or paying interest. These accounts operate differently, as instead of swap charges or credits, they may charge a fixed administration fee or widen spreads to compensate for the interest rate differentials.

In conclusion, swap charging in forex refers to the interest rate differential between two currencies, resulting in swap charges or credits for holding positions overnight. It’s an important consideration for traders engaging in longer-term positions and can impact overall profitability.

Triple swap charging

Triple swap charging, also known as triple rollover or triple swap, is a variation of swap charging that occurs in the forex market. It applies to positions that are held open over the weekend when the forex market is closed.

In standard forex trading, swap charges or credits are typically applied for positions held overnight, with the value reflecting the interest rate differential between the currencies involved. However, since the forex market operates continuously from Monday to Friday, no swaps are usually charged or credited for positions held open during the weekend.

Triple swap charging, on the other hand, accounts for the extended period of time over the weekend when the forex market is closed. When a position is held open from Wednesday to Thursday (rollover period), triple swap charging is applied to account for the interest rate differential for the extended three-day period, including the weekend.

The rationale behind triple swap charging is to compensate for the additional opportunity cost of holding a position open during the weekend when there is no trading activity and no opportunity to earn or pay interest. The exact calculation of triple swap charges depends on the interest rate differentials of the currency pair involved and the number of days the position is held open over the weekend.

Check your broker’s terms before trading

It’s important to note that not all brokers offer triple swap charging, and it may vary depending on the currency pair and the specific broker’s policies. You should review your broker’s terms and conditions or consult with your broker directly to understand if triple swap charging applies and how it is calculated.

Triple swap charging can have a significant impact on the cost or benefit of holding positions over the weekend. Traders who engage in longer-term trading strategies or those who trade currency pairs with substantial interest rate differentials should be aware of this kind of rollover and consider it as a factor in their trading decisions.

In summary, triple swap charging is a variation of swap charging in the forex market that applies to positions held open over the weekend. It accounts for the extended period when the market is closed and aims to compensate for the opportunity cost of holding positions during that time. Traders should check with their broker for specific details on triple swap charging and its implications for their trading activities.