Trend trading is one of the most widely used and effective trading strategies, especially in markets with clear directional momentum. The point is that by following the dominant trend, traders can capitalize on sustained price movements and reduce the noise that often plagues short-term trades. This article looks at trend trading, how and where it works best, and some key insights that can enhance your trend trading approach.

Table of contents

What is trend trading?

Uptrend

Downtrend

Sideways / Range

Advantages of trend trading

Clarity in direction

Potential for large gains

Less frequent trading

Fewer false signals

This strategy fits multiple timeframes

Disadvantages of trend trading

Trend reversals can be costly

Patience is required

Late entries

Choppy markets and consolidation

It requires discipline

Typical financial instruments for trend trading

Forex (Currency pairs)

Commodities (Gold, Oil, etc.)

Equities (Stocks)

Indices (S&P 500, Nasdaq, etc.)

Cryptocurrency

How to identify trends

Moving averages

Trendlines

Price action

Technical indicators

Risk Management in trend trading

Trailing stop losses

Position sizing

Confirm trend reversals

Patience and discipline

Conclusion

My products in detail

What is trend trading?

Trend trading is a strategy based on identifying and following a market’s prevailing trend. In simple terms, “the trend is your friend” serves as the guiding principle of this approach. Trends can move in one of three directions:

- Uptrend. The price constantly rises.

- Downtrend. The price constantly falls.

- Range. The price does not move in any particular direction.

You can see this clearly in the pictures below.

Uptrend

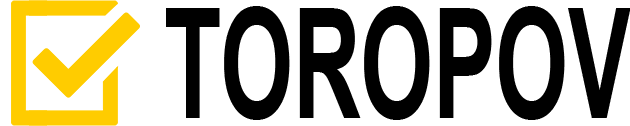

The price consistently makes higher highs and higher lows, indicating bullish market sentiment. Uptrends are especially typical for the stock market, where they can last for years and decades.

The distinctive feature of a long bullish trend is that you can buy an asset at any time. The trend will still pull the price above your purchase level. But there are nuances.

Downtrend

The price forms lower highs and lower lows, reflecting bearish conditions. Prolonged price drops happen in any market.

Typically, a good pullback in the stock market is a great opportunity to buy shares at a low price. However, the bearish trend itself can be used to make a profit.

Sideways / Range

The price moves within a confined range without a clear upward or downward trajectory. The market most often finds itself in this state.

Trend traders aim to enter trades in the direction of the trend and hold their positions for as long as the trend remains intact. They use technical analysis to find optimal entry and exit points.

Advantages of trend trading

Clarity in direction

One of the biggest advantages is that it simplifies decision-making by providing a clear market direction. When a strong trend is in place, traders don’t need to worry about market noise, making it easier to determine trade entries and exits.

Potential for large gains

Following a tendency often allows traders to ride large market moves, as trends can last for weeks, months, or even years.

Unlike scalping or day trading strategies that rely on quick, small profits, trend trading provides opportunities to capture significant price movements.

Less frequent trading

Since trend traders focus on identifying major market moves, they tend to take fewer trades than short-term strategies like scalping or swing trading. This can reduce the emotional and psychological stress of constant market engagement while also reducing transaction costs.

Fewer false signals

In comparison to range-bound or choppy markets, trends provide fewer false signals. A well-established trend reduces the likelihood of getting caught in sudden reversals, as the market momentum is clearly defined.

Trend trading fits multiple timeframes

Whether a long-term investor or a day trader, you can adapt this strategy to fit your style. Trends are present across different trading horizons, from daily charts to weekly or monthly timeframes.

However, you need to be very careful when you transfer the same strategy from one time frame to another. Prices do not behave the same on different time frames and this can significantly affect your strategy.

Disadvantages of trend trading

Trend reversals can be costly

One of the biggest risks in trend trading is a price reversal. Markets don’t trend forever, and entering a position just as the trend reverses can result in significant losses if you don’t exit quickly. Identifying when a trend is about to end is not always easy.

Patience is required

Trend trading often requires holding positions for extended periods, which can test a trader’s patience.

Staying in trade through market pullbacks, corrections, or short-term reversals is challenging for many traders.

Late entries in trend trading

A common problem with following a trend is the risk of entering the trade too late. Often, by the time a trend is confirmed, much of the initial move has already occurred, potentially limiting the profit potential of the trade.

Choppy markets and consolidation

Trend trading is less effective in range-bound or sideways markets where price action lacks clear direction. In such markets, traders may experience multiple false signals or become trapped in unproductive trades.

Trend trading requires discipline

Trend trading demands a disciplined approach, as traders must stick to their plan even during short-term volatility. Exiting a trend prematurely due to minor corrections can result in missed opportunities while staying too long in a weakening trend can lead to losses.

Typical financial instruments for trend trading

Certain financial instruments are better suited for trend trading, often due to their liquidity, volatility, or the presence of long-lasting trends. Below are some of the most common markets where these strategies thrive:

Trend trading in Forex (Currency pairs)

Currency pairs, especially the major pairs like EUR/USD, GBP/USD, and USD/JPY, are highly liquid and often exhibit clear, sustained trends due to macroeconomic factors like interest rate changes and geopolitical events. The forex market’s 24-hour nature and liquidity make it ideal for trend traders.

Commodities (Gold, Oil, etc.)

Commodities such as gold, silver, oil, and agricultural products are highly influenced by supply and demand dynamics, geopolitical events, and economic conditions. These factors can lead to prolonged trends, making commodities prime candidates for trend trading.

Equities (Stocks)

Individual stocks, particularly large-cap stocks, can experience significant trends based on corporate earnings, product launches, or sector growth. Similarly, sector-based Exchange Traded Funds (ETFs) that track specific industries can exhibit strong trends.

Indices (S&P 500, Nasdaq, etc.)

Stock market indices often show trends that reflect the overall health of the economy. When an index like the S&P 500 or the Nasdaq is trending upward, it often signifies broad-based economic growth, providing trend traders with ample opportunities.

Cryptocurrency

Cryptocurrencies like Bitcoin, Ethereum, and others are notorious for their volatile price movements, which often lead to sharp trends. Trend traders can take advantage of these long-lasting, high-momentum moves, although the volatility requires careful risk management.

How to identify trends

Trend identification is a critical component of successful trend trading. Here are some commonly used methods for spotting trends:

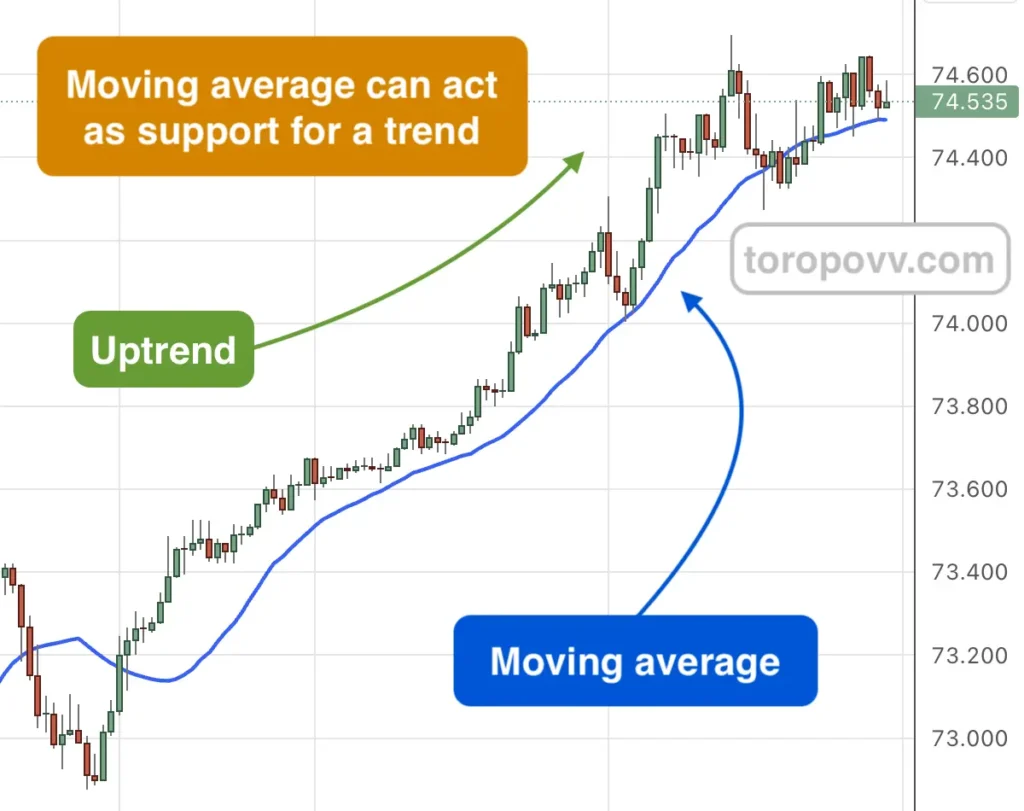

Moving averages

Moving averages (such as the 50-day or 200-day moving average) are widely used to smooth out price data and highlight trends.

A common rule of thumb is that when the price is above a rising moving average, the market is in an uptrend, and when the price is below a declining moving average, the market is in a downtrend.

Trendlines

Drawing trendlines between significant highs or lows can help visually confirm a trend. In an uptrend, the trendline connects the higher lows, while in a downtrend, it connects the lower highs.

Sometimes trend lines very accurately outline the boundaries of price movement. But very often it happens that these lines are broken and cannot be used to enter the market.

Price action

Observing the price making higher highs and higher lows (uptrend) or lower highs and lower lows (downtrend) is a classic method for identifying trends.

If we want to follow the trend, whenever there is a sharp change in prices we must join that movement. This is the basic idea that gives traders an advantage. You must bet on the dominant force in the market.

Technical indicators for trend trading

Indicators like the Average Directional Index (ADX) can measure the strength of a trend. For example, an ADX value above 25 generally indicates a strong trend, while a value below 20 suggests a weak or nonexistent trend. Generally speaking, there are a huge number of technical indicators for trading that you can select for yourself and use what suits you best.

Risk Management in trend trading

Even in a trending market, risk management is crucial to protect against potential reversals or unexpected volatility. Here are some key practices for managing risk:

Trailing stop losses in trend trading

A trailing stop loss is an effective way to lock in profits while allowing your position to continue benefiting from the trend. As the trend progresses, the stop loss moves along with the price, ensuring that you capture gains if the trend reverses.

Position sizing for trend trading

Trend trading often requires holding positions for longer, so proper position sizing is essential. Avoid over-leveraging, as market corrections or pullbacks can trigger large drawdowns if your position is too large.

Confirm trend reversals

Before exiting a trade, ensure that the trend is truly reversing by using technical signals like a break of a key trendline, moving average crossover, or divergence on momentum indicators.

Patience and discipline

The most successful trend traders wait patiently for high-probability setups and avoid chasing trades. Enter the trend at optimal levels and hold your position as long as the trend remains intact.

Conclusion

Trend trading is a robust strategy for traders and investors looking to capture sustained market momentum. With the potential for large gains and fewer trades, it appeals to those who prefer a more structured and long-term approach. However, it requires patience, discipline, and a solid understanding of market trends to succeed.

While trend reversals and market volatility present risks, proper risk management and the use of reliable trend-identifying tools can help traders mitigate losses and maximize profits. Whether in forex, commodities, stocks, or indices, following the trend remains one of the most effective methods for capitalizing on market movements, offering traders a significant edge in capturing long-term trends.

Luckily, my products already do all this automatically. These are reliable trading algorithms that do not get tired and do not make mistakes in their calculations. Try them for free. Happy trading!

My products in detail

Learn more about all my products for traders and unlock the potential of automated trading!